__________________________________________________

PAYMENT PROCESSING MADE VERY EASY WITH US . . .

Very Fast Online Application! Fast Approvals! Same Day Funding! No Cancellation Fees! Transparent Pricing! Secure Transactions! Free Application & Set-up! Free Cost Comparison!

—————————————————————————

ACQUIRERS & PROCESSORS

FAST Online Application

〰️

FAST Approval

〰️

SAME Day Funding

〰️

FAST Online Application 〰️ FAST Approval 〰️ SAME Day Funding 〰️

PV Brands Payments or PV Pays proudly offers payment solutions for virtually all business types and sizes. Our Account Executives have the experience and knowledge to help you select the right pricing model and equipment for you and your business needs to thrive! Let us help you choose the right solution for your business today!

Let’s THRIVE Together . . .

Small businesses are the heart and soul of our country.

They support the communities we live in, through active participation and contributions to charities, schools, sports teams, dance teams and much more.

More of every dollar you spend stays within your local community when you shop at a Small Businesses, plus it feels great knowing you are supporting your local community.

Transparent Pricing

〰️

SECURED Transactions

〰️

FREE Cost Comparison

〰️

Transparent Pricing 〰️ SECURED Transactions 〰️ FREE Cost Comparison 〰️

Get FREE Quote Now ! ! !

What is a merchant account?

A merchant account establishes a relationship between a business and a merchant services provider, like a bank. This agreement allows a business to accept credit cards and debit cards, along with other forms of payment. Not all merchant services providers require a merchant account. All you need is a dedicated bank account to process payments with PV Brands Payments.

Why do you need a merchant service provider?

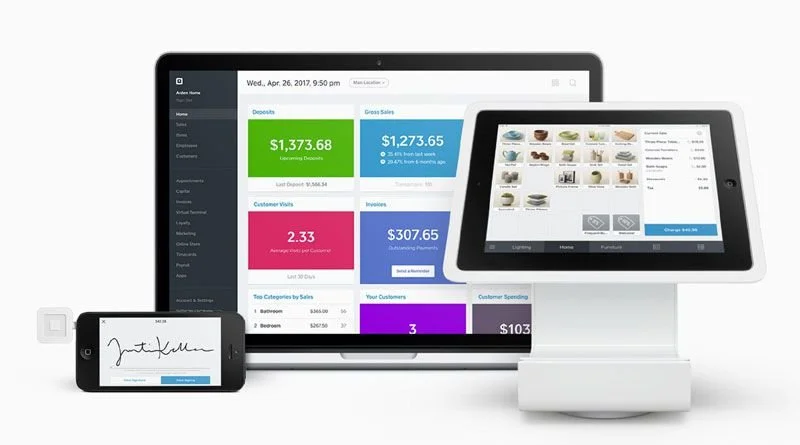

Merchant services providers allow businesses to accept credit, debit cards and other forms of payment online, through a payment card reader, or a point-of-sale (POS) system. Many entities are authorized to be merchant services providers. They generally fall into three categories: banks, independent sales organizations (ISO), and fintech companies like PV Brands Payments.

We work with some of the largest e-commerce sites on the web today, delivering an expert range of processing solutions that we can tailor, at record speed, to your needs – and always driven by our focus on helping to increase our customers’ profits.

We’re big on delivery – and that’s not just a mantra. Everything above is meaningless hot air unless we can deliver solutions efficiently and effortlessly. Many claim it – but we consistently do it. And we do it well. That’s why many of our customers stay with us for years. They trust us to keep delivering.

-

Security at The Fastest Speed

We specialize in secure, high-speed, high-volume technology solutions for the e-Commerce and card-not-present marketplace and we work with virtually any access point or device, from mobiles, PCs and electronic terminals to internet gateways, host interfaces, APIs and POS systems.

-

Technology - The World of Payments

This is a space we know. We’re passionate about what we can do for our customers – and the speed with which we can do it. Our engineers and designers are world class – backed up with enthusiasm, knowledge, ideas and ability. That makes us a bit special.

The future of payment. It’s here NOW ! ! !

The PV Payments Network

Our PCI DSS certified compliant checkout enables you to accept card and mobile payments in multiple currencies and countries.

The PV Payments Services all under one roof.

-

Entity Onboarding Engine

-

Permission Engine

-

Commissions & Fees Engine

-

Authorization Engine

-

Clearing Engine

-

Interchange Engine

-

Disputes Engine

-

Fraud Engine

-

Reporting Engine

-

Exchange Engine

-

Reconciliation Engine

-

Settlement Engine

__________________________________________________

WE OFFER SECURE PAYMENTS GLOBALLY

—————————————————————————

“ SECURE PAYMENTS ANYWHERE “

The PV Payments High-Risks Merchants

“ High Risk Industries. “

Some industries and sectors of business are always called out as high-risk. Frequently these include:

• Pharmaceuticals • Gambling • Gaming • Adult • Insurance • Air travel • Financial Services • Telemarketing • CBD Business • Online Casinos

This is by no means all of them should always consult a full list of high-risk industries before you begin your merchant account application journey. That way there is less likely many nasty surprises further down the road. It’s worth stating here and now that not all high-risk industries are bad businesses. Many high-risk merchants are perfectly legitimate merchants who just happen to operate in a sector that is categorized as “high-risk.”

There are acquirers that specialize in high risk and you will have to pay for that specialty. However, PV Payments does not target high risk businesses, but we evaluate all accounts on their own merit and will do our very BEST to help the business succeed where others just….plainly Turned Them AWAY ! ! !

So let’s us dig in a little deeper…

Heavily regulated industries like pharmaceuticals and gambling are usually classified as high-risk as they are prone to high levels of regulation, making it difficult to predict the long-term viability of a business model (this increases the risk of the business failing).

AND also means the payment processor may contravene the laws or regulation itself. That is a big risk.

Obviously breaking laws or regulations carries criminal consequences. Businesses with high levels of cash takings are also usually classified as high-risk as they can be used for money laundering. Again, another big risk.

Acquirers historically developed from banks who generally have a pious & puritanical approach to managing their global reputations.

Merchant business that could perhaps bring (what they call) reputational damage to the institution are very unwelcome and are classified immediately as high-risk. We take a more objective approach.

Of course many of these activities are perfectly legal — for example, adult and high-interest short-term money lending but do not pass muster with more ancient institutions.

So it is always worth talking to us – our view does not share that level of piousness. We’ll only say no if we need to.

Mastercard’s MATCH (Member Alert to High-Risk Merchants) Database holds an extensive database of ‘risky’ businesses. Merchant account providers use MATCH to quickly screen out high-risk businesses. We do the same.

Businesses are entered onto the list if their merchant accounts have been terminated and this can happen for a number of different reasons.

Some of the most common include: receiving a high number of chargebacks, money laundering, violating terms and conditions, convictions for fraud, bankruptcy or illegally obtaining assets.

CREDIT RISKS

Industries with a time between payment and fulfillment are often flagged up as high-risk. Industries like travel, transport and home interiors where the cardholder pays often many months before the merchant delivers the order. If the merchant goes bust during the delay, PV Payments becomes liable hence the increased risk.

Businesses with a high incidence of chargebacks are also seen as high-risk as the acquirer is liable for chargebacks should the merchant go to the wall. Third party fulfillment businesses, property leasing agents for example, come under the category of high risk – because the service is delivered by the owner or owner’s maintenance team.

AVOID CHARGEBACKS

From the perspective of an acquirer, nothing is more worrying than the threat of a mass of chargebacks hanging over a company.

That’s because if the company fails, the acquirer becomes liable for all those disputed charges.

THIS IS WHY ITS VERY IMPORTANT TO WORK WITH THE COMPANY THAT CAN SET YOUR BUSINESS UP TO ACCEPT CRYPTO AS A FORM OF PAYMENT.

ONCE THE CUSTOMER PAYS WE SETTLE THE TRANSACTION IMMEDIATELY WITHIN LITERALLY . . . 7 S E C O N D S . . .